Nicholas Varner – Black Tie Title President

This article strives to be fun, thought-provoking, and informative, but it’s just one person’s opinion. The views expressed are not designed to be Legal or Financial advice. This is just How I See It…

Operating a Title Company gives us a unique position in a Real Estate transaction to view what is happening in the broader market. We are able to participate in commercial purchases, commercial refinances, owner occupant transactions, residential refinances, and investor transactions. This variety of transaction types means that we get to see it all instead of targeting one niche of the market as loan professionals, investors, and realtors so often need to do to stay competitive in the marketplace.

One of the biggest things we noticed closing out 2021 is that the loan market is still very much in risk-on mode. There is a large appetite for loan origination from both loans that are sold to Fannie/Freddie and to private investors. Hard money loans are also becoming a much more mature product. It used to be that hard money loans would flirt with usury rates (18%), but now you are seeing rates come down for seasoned investors that want to buy more properties, specifically in the 1-4 family residential space, anywhere between 4-6% 30 year-fixed products are possible without showing a tax return to lenders.

Owner occupants, as well, are benefiting from a climate of low interest rates and a market that across much of the country continues to see appreciation in home prices. Non-QM products also help small business owners buy owner occupant properties. Historically low interest rates are not likely to last forever. Despite the rising prices, buying a home has never been a better option for first-time home buyers. That is what we believe too right now, based on interest rates. If someone is a buy/hold investor or first-time home buyer, and you can get 4-6% fixed rate loans or 2-4% fixed rate loans, respectively, it really is a golden opportunity.

With historic printing of money from the Federal Reserve and the reluctance to raise interest rates very quickly we may very well see additional appreciation in housing prices and low costs to borrow money. These conditions all align with it being a great time to purchase real estate or refinance. Do not get stuck thinking that these rates are normal, they are not normal at all, this is an opportunity to get access to credit at low costs. We hear consistently from borrowers and Real Estate professionals that this looks like 2005-2009 all over again. We think that they could not be more wrong, for several reasons:

- Interest Rates in 2005-2007 were much higher than they are today.

- Loan Types in 2005-2007, a majority of failing mortgages in 2005 were No Doc loans, Adjusted Rate Mortgages meaning that after the initially teaser period loans would reset

- Technological advances from 2000-2020. The Internet, iPods, iPhones, iPads, Amazon, Google, Data, Lions, Tigers, Bears…a lot of changes have happened in our world over the past twenty years, but these changes have had a deflationary effect on our lives and the cost of goods and services. We have come a long way in a short period of time and we will continue to see advancements, but I think we will see diminishing returns over the next twenty years compared with the last twenty years with respect to technology’s effect on prices.

- Supply chain disruptions. A unique inflationary problem that is not likely to subside any time soon.

- Printing of money during the Great Financial Crisis was designed to cover bad loans and failed companies or trying to stop a greater fallout from happening. However, printing of money over the past 24 months has been fundamentally different. We are starting to think that because we have been doing something for so long (printing money) that there is no side effect to continue on the path we are on.

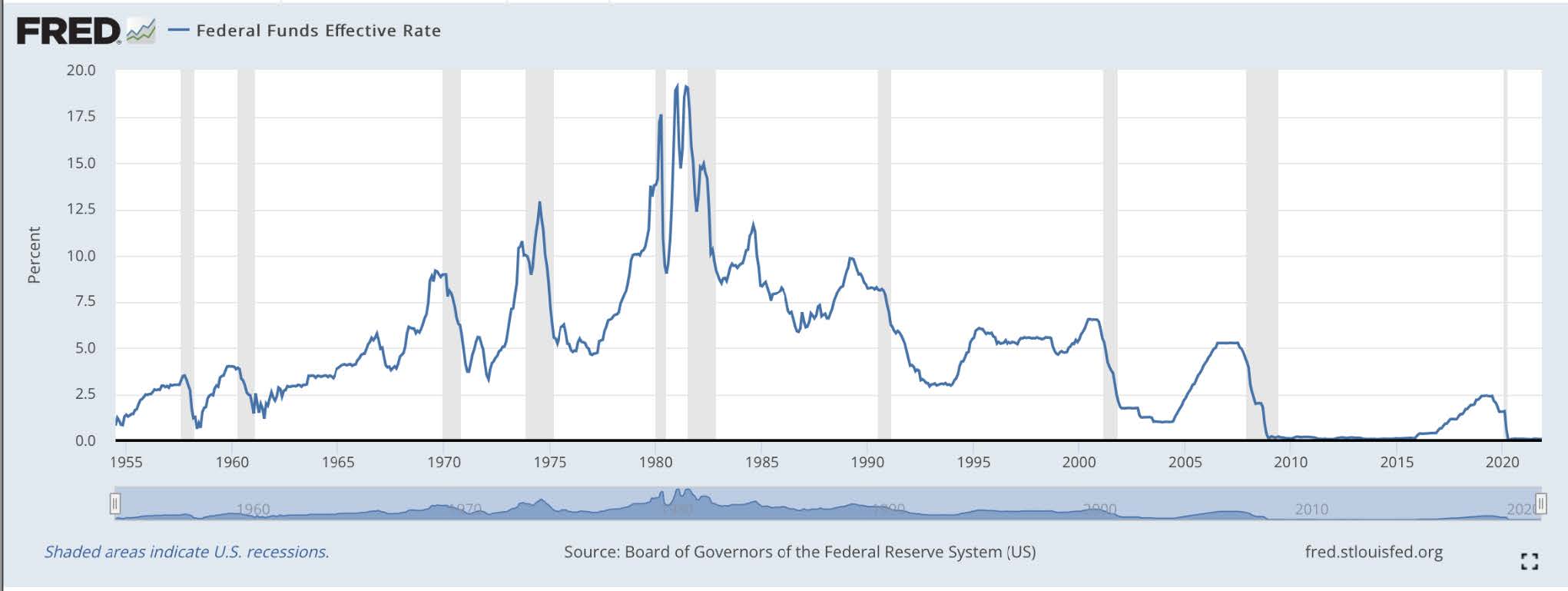

- Central banks holding rates below zero, at zero, or near zero. This has never happened before. Central bankers would like to convince us that they can turn the economy on and off like a faucet, do not be fooled. They are not in total control. Here is a look at interest rates since the 1950s.

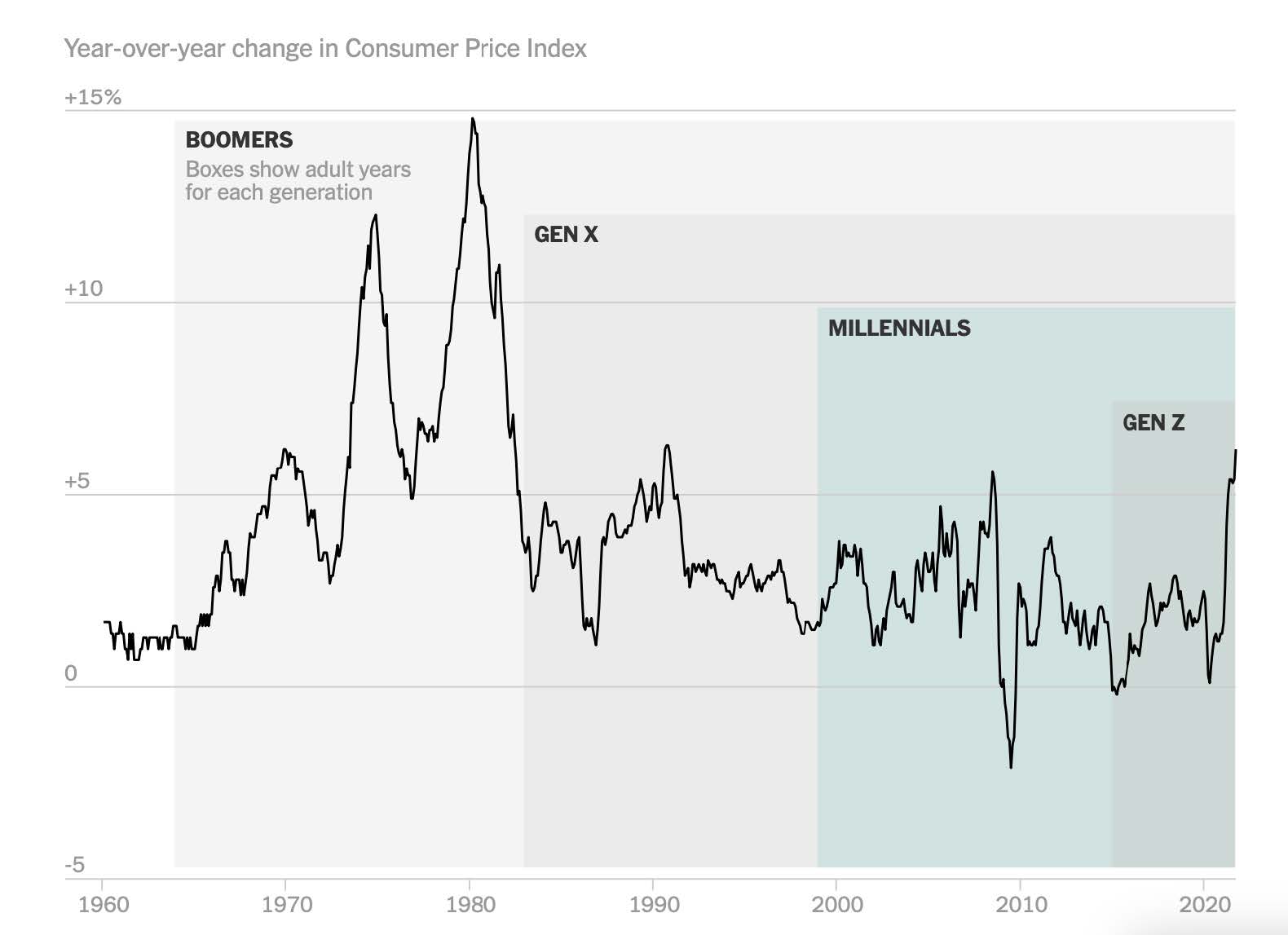

The next challenge we are going to face is going to resemble the late 1970s and early 1980s, not the Great Financial Crisis of 2007-2009. That was an inflation crisis where prices skyrocketed and supplies, well you had to wait and hope that you would get something. The reality is that I am not clairvoyant, this is already happening. Yesterday, I went to Costco and they limited how many paper towels I was allowed to buy. Here is a chart of inflation over the past 60 years, courtesy of my former employer The New York Times.

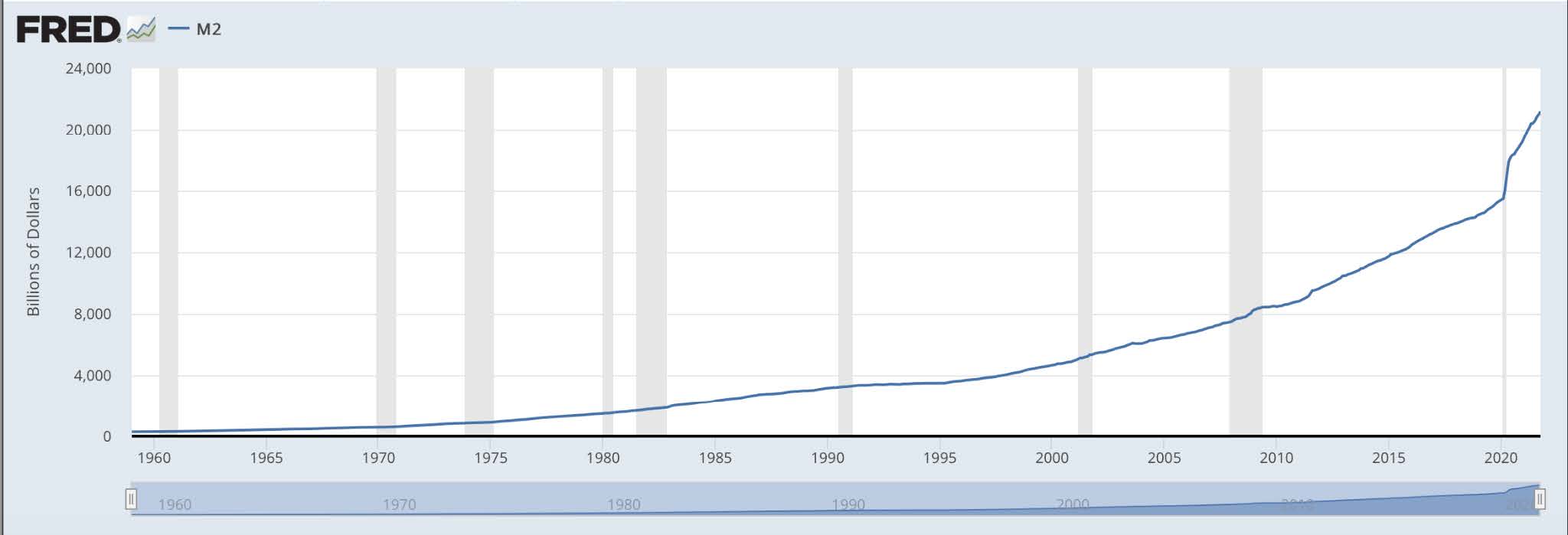

Here is why I think we should collectively buckle up in the next decade, so we have rates at zero and we have inflation starting to tick up. See the chart below for total currency in circulation over the past 60 years.

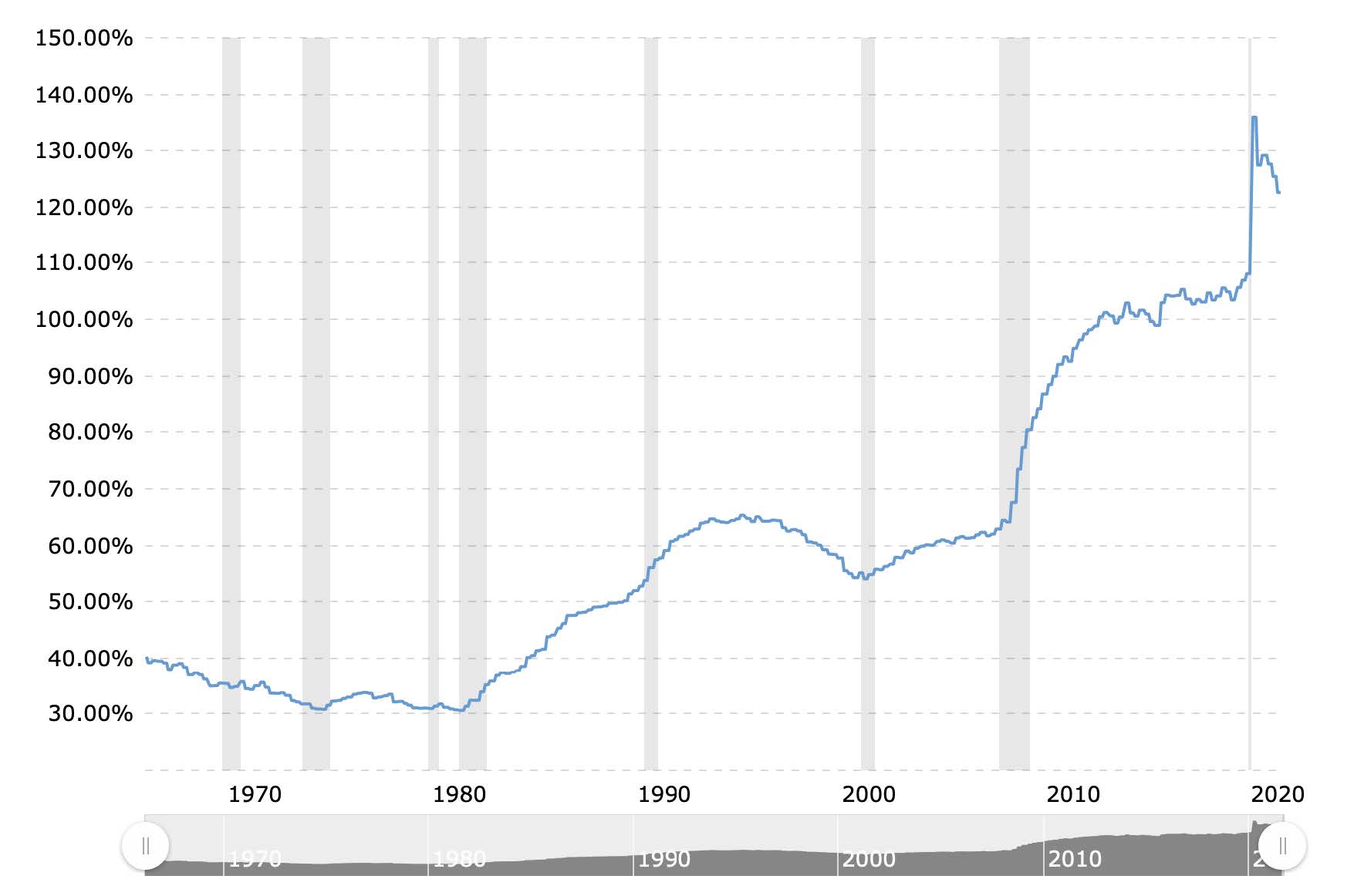

In the Carter administration and Reagan administrations, inflation was a threat to the country, the Federal Reserve throttled inflation by setting rates well into double digits. We cannot do that this time. Here is a chart that shows our historical Debt to GDP.

When Reagan took office in 1980, Debt to GDP was 31%, today we are 122%, meaning we are the biggest debtors, if the Federal Reserve raises interest rates substantially we will choke so they will not meaningfully raise rates. In an inflationary climate, you cannot hold cash and hope for the best, you need to place your cash into real assets and hope they can keep pace with inflation or even outpace inflation. Starting businesses where price sensitivity is not a problem is another way to combat inflation. Geographical diversification could also be an area that some want to consider, for right now, the Dollar is still strong but there are no guarantees for the future. Real Estate and the stock market have been red hot based on the aforementioned trends, I think that can continue, but where is the next great frontier going forward? Crypto? Digital Currencies? Digital Art? Farmlands? Space?

In 2000, we were all hoping the world would still be there when the clock hit midnight. No one could perfectly see the next 20 years of innovation, but there were foreshadowings of what was to come. We are seeing some very clear signs right now, doing nothing and hoping for the best is not a strategy. Understand the economic landscape, make a plan that works best for you and execute.

Happy investing and I hope to see you at the Closing Table.

Sincerely,

Nicholas Varner

Principal Owner, Black Tie Title

Want to schedule a call with us?

Complete the form below to request a callback.